How to Protect Your Identity in 2024

Raise Your Credit Score in 2024

In today’s financial landscape, having a good credit score is essential for achieving various milestones such as buying a home, obtaining a car loan, or even securing a competitive interest rate on credit cards. Your credit score not only impacts your ability to access credit but also influences the terms and conditions offered to you by lenders. If you’re looking to improve your financial standing this year, focusing on raising your credit score is a smart move.

Introduction to Credit Scores

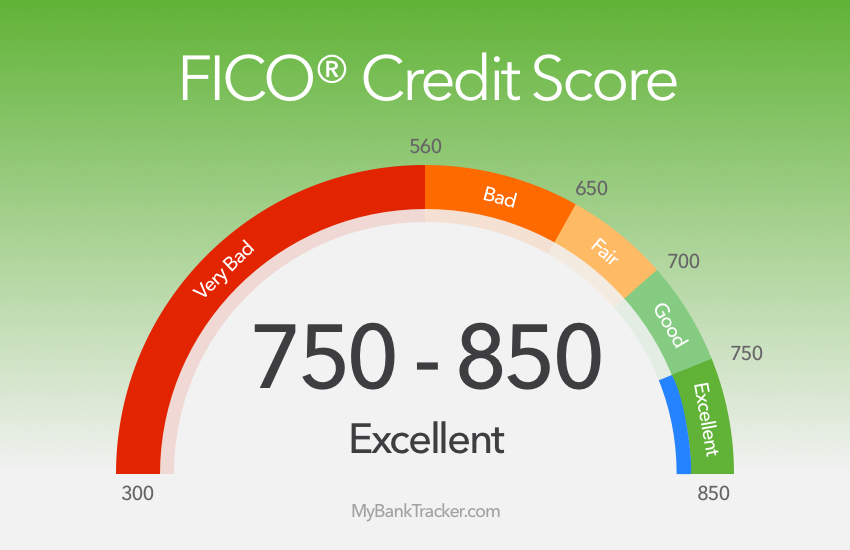

Before delving into strategies for boosting your credit score, it’s crucial to understand what a credit score is and how it’s calculated. A credit score is a numerical representation of your creditworthiness, ranging typically from 300 to 850. The higher your score, the more favorable terms you’re likely to receive from lenders.

Importance of a Good Credit Score

A good credit score can open doors to various financial opportunities. It can make it easier to qualify for loans and credit cards, often at lower interest rates. Additionally, landlords, insurance companies, and even potential employers may assess your credit score to evaluate your trustworthiness and reliability.

Understanding Credit Score Factors

Several factors contribute to your credit score, each carrying a different weight. Understanding these factors can help you prioritize actions to improve your score effectively.

Payment History

Your payment history is the most significant factor influencing your credit score. It reflects whether you’ve paid your bills on time and accounts for approximately 35% of your score.

Credit Utilization

Credit utilization measures the amount of credit you’re using relative to your total available credit. Aim to keep your credit utilization below 30% to demonstrate responsible credit management.

Length of Credit History

The length of your credit history accounts for around 15% of your credit score. Generally, the longer you’ve had credit accounts in good standing, the better it is for your score.

Types of Credit in Use

Lenders prefer to see a mix of different types of credit, including credit cards, installment loans, and mortgages. This diversity demonstrates your ability to manage various financial obligations responsibly.

New Credit Inquiries

Opening multiple new credit accounts within a short period can negatively impact your credit score. Each new inquiry can temporarily lower your score, so avoid unnecessary credit applications.

Strategies to Raise Your Credit Score

Now that you understand the key factors influencing your credit score, let’s explore some actionable strategies to help you raise it:

Monitor Your Credit Report Regularly

Regularly reviewing your credit report allows you to identify errors or fraudulent activity promptly. You’re entitled to one free credit report from each of the three major credit bureaus annually, so take advantage of this opportunity.

Pay Bills on Time

Late payments can significantly damage your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

Reduce Credit Card Balances

High credit card balances relative to your credit limits can hurt your credit score. Aim to pay down your balances and keep them low to improve your credit utilization ratio.

Avoid Opening Too Many New Accounts

Each new credit inquiry can temporarily ding your credit score. Be selective about opening new accounts and avoid applying for credit unnecessarily.

Maintain a Mix of Credit Types

Having a diverse mix of credit accounts, such as credit cards, student loans, and mortgages, can positively impact your credit score.

Keep Old Accounts Open

Closing old accounts shortens your credit history, which can lower your score. Unless there are compelling reasons to close an account, consider keeping it open to maintain a longer credit history.

Tools and Resources for Improving Credit

Several tools and resources are available to assist you in your journey to better credit:

- Credit Monitoring Services: Enroll in credit monitoring services to receive alerts about changes to your credit report, suspicious activity, or potential identity theft.

- Budgeting Apps: Use budgeting apps to track your spending, set financial goals, and manage your finances more effectively.

- Credit Counseling: Consider seeking guidance from a credit counseling agency to develop a personalized plan for improving your credit.

- Secured Credit Cards: If you’re struggling to qualify for traditional credit cards, a secured credit card can be a valuable tool for rebuilding credit.

Common Mistakes to Avoid

In your quest to improve your credit score, be mindful of common mistakes that could derail your progress:

- Closing Old Accounts: As mentioned earlier, closing old accounts can shorten your credit history and lower your score.

- Maxing Out Credit Cards: High credit card balances can signal financial distress to lenders and harm your credit score.

- Ignoring Errors on Credit Reports: Review your credit report regularly and dispute any inaccuracies promptly to ensure your score is based on accurate information.

Patience and Persistence: The Key to Success

Improving your credit score is not an overnight process. It requires patience, discipline, and consistent effort over time. By implementing the strategies outlined in this article and avoiding common pitfalls, you can steadily raise your credit score and improve your financial health.

Conclusion

Your credit score plays a crucial role in your financial well-being, influencing your ability to access credit and the terms you’re offered by lenders. By understanding the factors that affect your score and implementing proven strategies for improvement, you can take control of your financial future and achieve your goals.

FAQs

How long does it take to raise your credit score?

- The time it takes to raise your credit score depends on various factors, including the severity of past credit issues and the consistency of your efforts. Generally, you may start seeing improvements within a few months, but significant increases could take years of responsible credit management.

Will checking my credit score lower it?

- No, checking your own credit score is considered a soft inquiry and does not affect your score. However, hard inquiries from lenders can have a temporary impact on your score.

Can I improve my credit score if I have a history of late payments?

- Yes, even if you’ve had late payments in the past, you can still improve your credit score by making timely payments going forward and demonstrating responsible credit behavior over time.

Should I close old credit accounts to improve my credit score?

- Closing old credit accounts can actually lower your credit score by shortening your credit history

Our SecurePreferred plans give you and your family financial peace of mind by offering a variety of affordable identity protection options. See which plan best suits your needs.

The Unfortunate Tale: Identity Theft, Job Loss, and Legal Consequences

In an accelerating era of new technology at our fingertips, tapping into security is a great idea! Perhaps you have encountered some mishaps, or heard stories of not so fun experiences that unfortunately lurk in the shadows of all the benefits we enjoy. With our new cyber world adventures, identity theft is a real threat to avoid, so keep your “happy time” safe!

In an accelerating era of new technology at our fingertips, tapping into security is a great idea! Perhaps you have encountered some mishaps, or heard stories of not so fun experiences that unfortunately lurk in the shadows of all the benefits we enjoy. With our new cyber world adventures, identity theft is a real threat to avoid, so keep your “happy time” safe!

Identity theft can be a very scary situation – probably the word [panic] comes to mind. It could be one of those o-my-god moments none of us want to experience, right? It’s like looking in the mirror one day and wondering where you are. You may want to scream, cry, call 911, break something, or sit in silent shock. You are grieving a loss, but not of a loved one. You just lost – well, a part of yourself.

Identity theft can be a very scary situation – probably the word [panic] comes to mind. It could be one of those o-my-god moments none of us want to experience, right? It’s like looking in the mirror one day and wondering where you are. You may want to scream, cry, call 911, break something, or sit in silent shock. You are grieving a loss, but not of a loved one. You just lost – well, a part of yourself.

If you are reading this, you know we are living through unprecedented times of uncertainty. You are searching for security. As the digital world continues to grow with new technology, so do the risks. Millions of identities are stolen every year. Billions of dollars are lost. Identity protection is a priority for many Americans in 2023. Here are some things you should know.

If you are reading this, you know we are living through unprecedented times of uncertainty. You are searching for security. As the digital world continues to grow with new technology, so do the risks. Millions of identities are stolen every year. Billions of dollars are lost. Identity protection is a priority for many Americans in 2023. Here are some things you should know.

You may be wondering if identity theft protection is necessary. After all, you’re careful with your personal information, and you’ve never been a victim of identity theft before.

You may be wondering if identity theft protection is necessary. After all, you’re careful with your personal information, and you’ve never been a victim of identity theft before.